Introduction to Propbase

Propbase is a rising platform stepping foot into the modern real estate world. With a powerful idea of tokenizing the real estate market in South East Asia. While a lot of people are searching for credible information regarding this platform, there is very limited data available online. You have arrived at the right place if you are caught in the same loop. Here, we have covered everything we have gathered from credible sources about Propbase (PROPS) to help you get to know it better. Let’s get started.

What is Propbase (PROPS)?

Propbase (PROPS) is a cryptocurrency associated with a tokenized real estate investment platform in South East Asia. Here is a quick rundown of the key points we know about this platform:

Function

Propbase allows users to invest in high-end real estate assets through fractional ownership, meaning you can buy a portion of a property with as little as $100.

Benefits

- Earn rental yield: Potentially receive a share of the rental income generated by the property.

- High liquidity: Easier to buy and sell compared to traditional real estate investments.

- Lower barrier to entry: Invest in real estate with a smaller amount of money.

What is the Vision of Propbase?

Currently, there is very limited information available regarding the core vision and market potential of Propbase and its native token. While valid, here is what we can expect to see in the near future.

Democratizing Real Estate Investment

Propbase’s core concept revolves around fractional ownership, making real estate investment accessible to a wider audience. Their vision likely involves breaking down barriers to entry traditionally associated with real estate (large capital requirements, illiquidity).

Building a Transparent & Efficient Ecosystem

By leveraging blockchain technology, Propbase offers a potentially more transparent and efficient investment platform. Their vision might encompass creating a trustworthy and secure environment for real estate transactions.

Revolutionizing the Real Estate Market

With its innovative approach, Propbase might aim to revolutionize the real estate market by increasing participation, streamlining processes, and unlocking new investment opportunities.

Propbase Technological Framework

The following information may help you sketch the scope of the technological framework of Propbase.

Blockchain Technology

Propbase is known to utilize the Aptos blockchain, known for its:

-

- Scalability: Ability to handle a large volume of transactions efficiently.

- Fast Transaction Speeds: Quicker processing times compared to some other blockchains.

- Secure Environment: Strong security measures to protect user data and assets.

Tokenization Technology

This technology allows Propbase to represent real estate assets as digital tokens (PROPS) on the Aptos blockchain. Each token would likely represent a fractional ownership unit of a property.

Smart Contracts

These self-executing contracts could automate various aspects of the Propbase platform, such as:

-

- Managing fractional ownership distribution.

- Facilitating secure and transparent transactions between investors and the platform.

- Distributing rental income to token holders.

Additional Technologies

- Secure Storage: Propbase likely utilizes secure storage solutions to safeguard user data and private keys associated with their PROPS tokens.

- User Interface (UI) and User Experience (UX): A user-friendly platform is crucial for Propbase to attract investors. They might have developed a well-designed interface for managing investments and interacting with the platform.

Propbase Tokenomics and Rewards

Propbase utilizes a token called PROPS to power its real estate investment platform. Here is all you need to know about Propbase tokenomics and rewards based on available data:

Total Supply

Propbase has a fixed total supply of 1.2 billion PROPS tokens.

Token Distribution

The total supply is distributed as follows (percentages may vary slightly based on different sources):

- Crowd Sale (IDO): 20% – These tokens are offered to the public for investment purposes.

- Rewards Protocol: 35% – This significant allocation is likely used to incentivize user participation and platform growth.

- Company: 12% – Allocated for the development and operation of the Propbase platform.

- Foundation: 3% – Potentially reserved for long-term growth and initiatives of the Propbase project.

- Seed Funding: 5% – Likely allocated to early investors who supported the project’s development.

- Marketing & Advisors: 10% + 5% (combined) – Used for marketing efforts and potentially rewarding advisors who contributed to the project.

- Liquidity Pools: 10% – These tokens might be used to create liquidity pools on decentralized exchanges, facilitating easier buying and selling of PROPS tokens.

Vesting Schedule

Information on the specific vesting schedule for each allocation might be limited. However, some sources mention a vesting period of up to 60 months (5 years) for certain allocations like crowd sale tokens or company reserves. It means that tokens would not be immediately available but released gradually over a set time frame.

Rewards

This 35% allocation is a key aspect of Propbase’s tokenomics. Here is what we can potentially expect:

- Rewards for completing investments: Users who invest in properties through the Propbase platform might receive PROPS tokens as a reward.

- Early adopter benefits: Early users who join the platform could be incentivized with PROPS tokens.

- Staking rewards: Propbase might offer staking mechanisms where users lock up their PROPS tokens for a period to earn rewards.

- Community engagement rewards: PROPS tokens could be used to reward users for actively participating in the Propbase community.

Overall, Propbase’s tokenomics seem to focus on incentivizing user participation and platform growth. A significant portion of the token supply is dedicated to rewards, potentially attracting investors and promoting platform adoption.

Propbase Partnerships

Propbase appears to be actively forging partnerships to solidify its position in the real estate tokenization landscape.

Real Estate Developers

Propbase prioritizes collaborations with established real estate developers. Some confirmed partnerships include:

- Siamese Asset Public Limited Company: A renowned developer in Thailand, known for high-quality income-generating properties. This partnership enables Propbase to offer tokenized investment opportunities in these assets.

- Azure Rich Group (ARG): Propbase partnered with ARG to tokenize the prestigious Nebu World project, a 4-star 6-hotel development in Thailand.

Blockchain Technology Providers

- Aptos Labs: Propbase leverages the Aptos blockchain for its scalability, speed, and security. This partnership ensures a robust technological foundation for the platform.

Other Potential Partnerships

- Financial Institutions: Collaborations with banks or other financial institutions could enable easier onboarding of users and potentially offer financing options for real estate investments.

- Cryptocurrency Exchanges: Listing PROPS tokens on reputable cryptocurrency exchanges would increase liquidity and accessibility for investors.

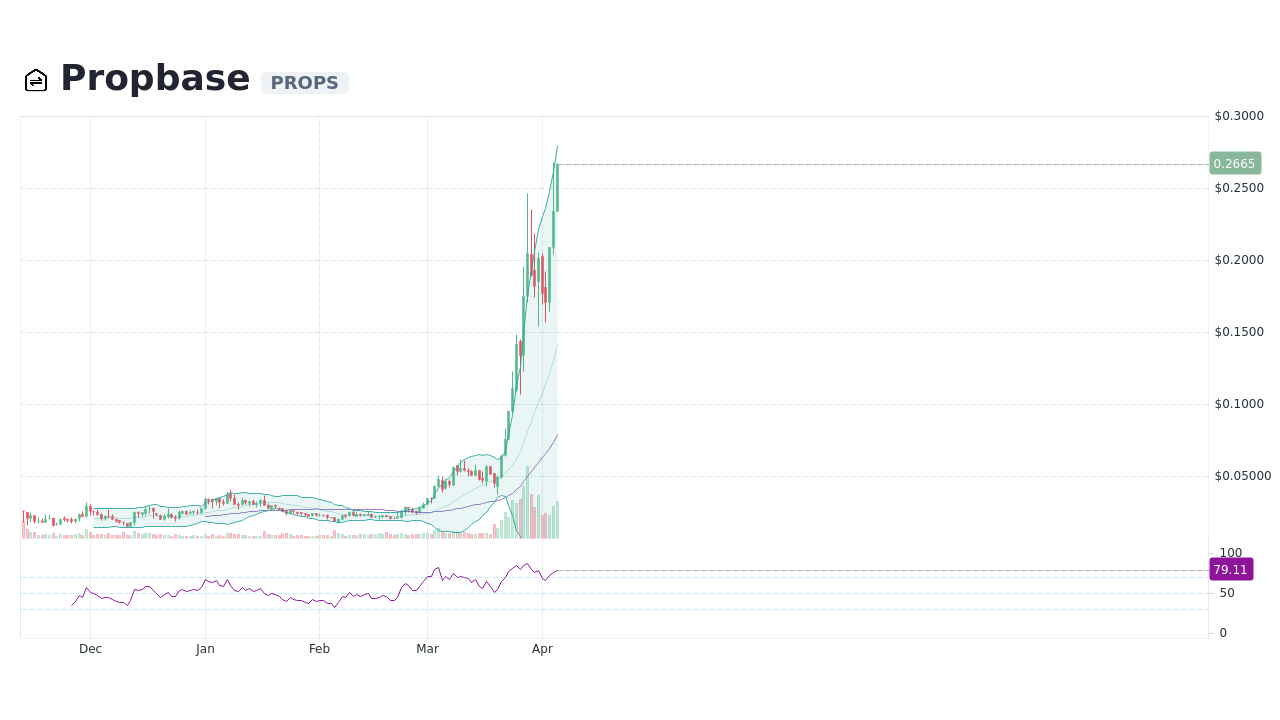

Propbase (PROPS) Price

As of today, the price of PROPS stands at $0.1746 according to the CoinMarketCap data. Meanwhile, the 24-hour trading volume is $873219.65.

How to Get Involved With Propbase (PROPS)?

There are a few ways you can potentially get involved with Propbase, depending on your specific interests:

Investing Through Propbase

- Join the Propbase Platform (if available): If Propbase has launched its platform, you could potentially invest in real estate assets through fractional ownership by becoming a user. It might involve signing up for an account and completing any necessary verification processes.

- Participate in a Potential Public Sale (IDO): Some sources mention a Crowd Sale (IDO) for PROPS tokens. If Propbase conducts a public sale, you could potentially invest in PROPS tokens during this event. However, keep in mind that regulations around cryptocurrency offerings can vary depending on your location.

Before investing in Propbase, conduct thorough research. Here are some crucial aspects to consider:

- Research the Real Estate Market: Understand the types of properties offered on Propbase and the associated risks and potential returns.

- Evaluate Cryptocurrency Risks: The cryptocurrency market is volatile, and investing in PROPS tokens carries inherent risks.